Below is a write up from the team at zkLing, a secure, unified multi-chain trading layer for DeFi & NFTs, and one of the defi startups invested in by Arrington Capital. We really appreciate their approach and technical expertise. For more information, please visit their website and follow them on Twitter.

___________________________________________________________________

Decentralized Finance, or DeFi, is having its most defining moment since ‘DeFi Summer’. Not due to endogenous factors but as a result of the wrecking ball of carnage driven by the recent implosion of CeFi. Massive and cascading liquidations as a result of a woeful mismanagement of risk and trust has led to centralized parties and platforms to become insolvent and more importantly lose users capital. It’s unclear when the destruction will end, another product of the opaqueness of centralized finance. Although most of this activity has occurred in lending platforms, the contagion and similar insolvency risks still remain with exchanges and other centralized platforms.

These recent events have reinvigorated the debate about the significance of DeFi and what it enables for its end users. Self-custody, permissionless, immutable contracts clearly defining risk in a transparent manner. Now, DeFi has its own host of issues as many protocols are still in their nascency and lack full ‘decentralization’. However, most would appreciate that the ideal end state of DeFi has clear advantages over its centralized counterpart.

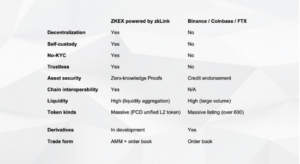

zkLink is an application-specific L2 network with the ambition to replace a major segment of CeFi, centralized exchanges, as a secure and unified interoperable trading layer.

The premise that zkLink could replace Binance for instance is not immediately clear in its description. However, we can reframe what centralized exchanges have become for most of its users, a multi-chain network with a suite of apps such as spot and derivatives trading and cross-chain bridging. We’ll revisit this framework later.

zkLink has a unique solution to multi-chain interoperability and its security by leveraging zero-knowledge proof technology.

Zero-knowledge validity proofs cryptographically verify and certify only valid transactions and cannot be manipulated or falsified. As a result, security of funds are guaranteed and any account states can be rolled back, even when all data on the zkLink engine is lost or compromised. This is an enormous improvement from existing interoperability protocols with large trust assumptions with asset security relying on a limited group of validator nodes within a Proof-of-Stake network. The security assumptions of zkLink are based on mathematical verification rather than economic assumptions based on the value of tokens.

zkLink’s multi-chain zk-rollup model achieves interoperability by generating zk-rollups on each respective chain and accomplishing consensus across each rollup. This is done in 4 broad steps:

- Commit – multiple transactions, including both base-layer chain and cross-chain transactions, are batched and uploaded to the smart contract on the base-layer together with a zk-SNARK. The on-chain data fulfills data availability so that account states can be retrieved if necessary.

- Prove – zk-proofs are submitted to the base-layer and verified by the smart contract that will emit an event with the current hash value or what is classified as the ‘final_root’.

- Consensus – an oracle network accomplishes interchange of the ‘final_root’ with each chain and compares for consensus.

- Execute – the zkLink engine guarantees that the new ‘final_root’ is correctly computed with the old ‘final_root’ and new transactions info, while the oracle network passes this to the other chain. Requests for funds flow are executed once these two steps are confirmed.

This model further dramatically minimizes trust assumptions by enabling users to interact with base assets native to their respective chains rather than wrapped assets that also come with their own set of security compromises.

zkLink not only solves liquidity fragmentation in a unique manner, but also takes it a step further: it “unifies” different kinds of stablecoins on separate chains.

This problem exists most prominently in stablecoins where each chain has its own version of the same token such as “USDT-Solana” vs “USDT-Ethereum”. Further fragmentation is exacerbated by conventional cross-chain bridges that introduce further wrapped versions as a product of burn/ lock and mint/ release mechanisms. A feature called protocol-controlled-debt (PCD) aggregates segmented liquidity across multiple blockchains by merging stablecoins on separate blockchains for use on the zkLink layer 2 solution. This enables deeper liquidity and promotes higher capital utilization rates.

A multichain world needs a unified, trustless and secure interoperability layer that offers all the functionality and user experiences of centralized networks. The final piece in achieving this feat is zkLink’s trustless application layer for external developers to seamlessly integrate into through APIs. APIs such as their currently available orderbook and AMM APIs enables developers to build easily on a cross-chain zk-rollup solution without the need for learning new programming languages or tooling. Additional APIs in their roadmap including derivatives, launchpads and NFT trading further expanding the possible functionality of the zkLink ecosystem.

ZKEX (testnet.app.zkex.com) is the first ecosystem application, a multi-chain orderbook DEX, that will offer CEX-like UI and UX with no slippage, no gas fees and instant finality but with the advantages of being fully non-custodial and trust minimized. Users would be able to trade spot assets native to their respective chains without having to trust centralized parties. For instance, users could trade the token CAKE on the BNB chain with UNI or USDT on the Ethereum chain all whilst on a single and secured layer 2 solution. This set of features means that traders could eventually keep all their assets on zkLink’s ecosystem for trading both major and longer tail assets from multiple chains and bridging cross-chain to leverage multi-chain DeFi. We believe once zkLink has matured to realize its full potential and suite of applications that there would be little reason for traders to continue to use a CEX.